Charlottesville Va Personal Property Tax Relief . taxes are due on june 5th and december 5th of each year. what types of personal property are taxable? The first half property* tax due date is june 25 and. How is the amount of tax determined? How is personal property assessed? — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. If these dates fall on a weekend, the deadline is extended to the. tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. pay personal property taxes by mail or in person.

from www.formsbank.com

taxes are due on june 5th and december 5th of each year. — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. How is personal property assessed? information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. The first half property* tax due date is june 25 and. How is the amount of tax determined? pay personal property taxes by mail or in person. what types of personal property are taxable? tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. If these dates fall on a weekend, the deadline is extended to the.

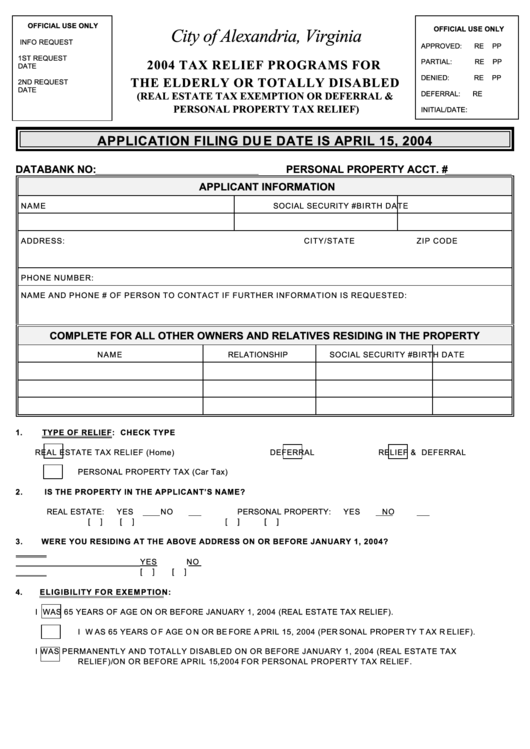

Fillable Real Estate Exemption Or Deferral And Personal Property Tax

Charlottesville Va Personal Property Tax Relief taxes are due on june 5th and december 5th of each year. If these dates fall on a weekend, the deadline is extended to the. How is personal property assessed? what types of personal property are taxable? information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. taxes are due on june 5th and december 5th of each year. The first half property* tax due date is june 25 and. pay personal property taxes by mail or in person. How is the amount of tax determined? tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the.

From learningschoolhappybrafd.z4.web.core.windows.net

Resale Certificate Louisiana Sales Tax Charlottesville Va Personal Property Tax Relief How is personal property assessed? How is the amount of tax determined? taxes are due on june 5th and december 5th of each year. what types of personal property are taxable? The first half property* tax due date is june 25 and. information and application forms for real estate tax relief for the elderly and disabled, real. Charlottesville Va Personal Property Tax Relief.

From www.exemptform.com

Virginia Out Of State Tax Exemption Form Charlottesville Va Personal Property Tax Relief How is personal property assessed? pay personal property taxes by mail or in person. The first half property* tax due date is june 25 and. tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. taxes are due on june 5th and december 5th of each year. information and. Charlottesville Va Personal Property Tax Relief.

From dxojnuysj.blob.core.windows.net

What Is A Transfer Tax Exemption at Myrtle Williams blog Charlottesville Va Personal Property Tax Relief If these dates fall on a weekend, the deadline is extended to the. tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. How is the amount of tax determined? taxes. Charlottesville Va Personal Property Tax Relief.

From www.signnow.com

Virginia Certificate of Exemption 20162024 Form Fill Out and Sign Charlottesville Va Personal Property Tax Relief taxes are due on june 5th and december 5th of each year. — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. tax bills are reduced by charlottesville’s expected reimbursement under the. Charlottesville Va Personal Property Tax Relief.

From printablethereynara.z14.web.core.windows.net

Arkansas Sales And Use Tax Exemption Form Charlottesville Va Personal Property Tax Relief pay personal property taxes by mail or in person. tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. taxes are due on june 5th and december 5th of each year. — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. How is the. Charlottesville Va Personal Property Tax Relief.

From www.exemptform.com

Wv Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller Charlottesville Va Personal Property Tax Relief The first half property* tax due date is june 25 and. tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. pay personal property taxes by mail or in person. — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. taxes are due on. Charlottesville Va Personal Property Tax Relief.

From www.fill.io

Fill Free fillable forms Montgomery County, Virginia Charlottesville Va Personal Property Tax Relief pay personal property taxes by mail or in person. If these dates fall on a weekend, the deadline is extended to the. tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. How is the. Charlottesville Va Personal Property Tax Relief.

From esmayconcordia.pages.dev

Nj Anchor 2024 Status Cybil Dorelia Charlottesville Va Personal Property Tax Relief The first half property* tax due date is june 25 and. pay personal property taxes by mail or in person. information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. taxes are due on june 5th and december 5th of each year. tax bills are reduced by. Charlottesville Va Personal Property Tax Relief.

From esmayconcordia.pages.dev

Nj Anchor 2024 Status Cybil Dorelia Charlottesville Va Personal Property Tax Relief taxes are due on june 5th and december 5th of each year. — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. The first half property* tax due date is june 25 and. How is the amount of tax determined? pay personal property taxes by mail or in person. How is personal. Charlottesville Va Personal Property Tax Relief.

From www.pinterest.com

Albemarle County, Virginia, Map, 1911, Rand McNally, Charlottesville Charlottesville Va Personal Property Tax Relief The first half property* tax due date is june 25 and. tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. How is the amount of tax determined? taxes are due on june 5th and december 5th of each year. If these dates fall on a weekend, the deadline is extended. Charlottesville Va Personal Property Tax Relief.

From www.formsbank.com

Top 21 Property Tax Exemption Form Templates free to download in PDF format Charlottesville Va Personal Property Tax Relief How is the amount of tax determined? The first half property* tax due date is june 25 and. — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. tax bills are reduced by. Charlottesville Va Personal Property Tax Relief.

From air-blocker.com

Virginia Tax Exemption Form Charlottesville Va Personal Property Tax Relief taxes are due on june 5th and december 5th of each year. pay personal property taxes by mail or in person. tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. How is the. Charlottesville Va Personal Property Tax Relief.

From games.assurances.gov.gh

Convo Exemption Form Liberty Charlottesville Va Personal Property Tax Relief If these dates fall on a weekend, the deadline is extended to the. pay personal property taxes by mail or in person. taxes are due on june 5th and december 5th of each year. The first half property* tax due date is june 25 and. How is personal property assessed? tax bills are reduced by charlottesville’s expected. Charlottesville Va Personal Property Tax Relief.

From www.co.alleghany.va.us

Ballot Sample 4 Alleghany County, Virginia Charlottesville Va Personal Property Tax Relief tax bills are reduced by charlottesville’s expected reimbursement under the personal property tax relief act from the. If these dates fall on a weekend, the deadline is extended to the. pay personal property taxes by mail or in person. what types of personal property are taxable? How is the amount of tax determined? — residents can. Charlottesville Va Personal Property Tax Relief.

From www.formsbank.com

Fillable Application For Real Estate Tax Exemption Or Deferral And/or Charlottesville Va Personal Property Tax Relief How is the amount of tax determined? — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. How is personal property assessed? If these dates fall on a weekend, the deadline is extended to. Charlottesville Va Personal Property Tax Relief.

From kellybmalena.pages.dev

Tax Exemption Form 2024 Pdf Download Breena Terrie Charlottesville Va Personal Property Tax Relief The first half property* tax due date is june 25 and. How is personal property assessed? How is the amount of tax determined? what types of personal property are taxable? — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. pay personal property taxes by mail or in person. If these dates. Charlottesville Va Personal Property Tax Relief.

From www.co.alleghany.va.us

SampleStructDrawWallSection Alleghany County, Virginia Charlottesville Va Personal Property Tax Relief If these dates fall on a weekend, the deadline is extended to the. information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. what types of personal property are taxable? — residents can apply for real estate tax relief online at www.charlottesville.gov/cor or make an. How is personal. Charlottesville Va Personal Property Tax Relief.

From printablelibmasks.z13.web.core.windows.net

Va State Tax Exempt Charlottesville Va Personal Property Tax Relief If these dates fall on a weekend, the deadline is extended to the. what types of personal property are taxable? information and application forms for real estate tax relief for the elderly and disabled, real estate tax exemption for. How is the amount of tax determined? — residents can apply for real estate tax relief online at. Charlottesville Va Personal Property Tax Relief.